philadelphia wage tax for non residents

Non-residents of Philadelphia are also subject. The new non-resident rates will be a flat 344 for Wage Tax and 344 for Earnings Tax they were previously 34481.

Philadelphia Wage Tax Cut What Does It Mean For Workers On Top Of Philly News

City wage tax applies to all wages earned by Philadelphia residents regardless of whether they work inside or outside of the city.

. 2020 Philadelphia City Wage Tax Refunds for Non-City Residents Required to Work from Home Due to COVID-19. 38712 for Philadelphia residents 34481 for non-residents. From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center.

The new rates are as follows. 38712 for Philadelphia residents 35019 for non-residents. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the.

Wage Tax policy guidance for non-resident employees. For high-priced pitcher Justin. PHILADELPHIA WPVI -- After.

And the visiting Houston Astros will also have to pony up their share of the roughly 3 non-resident city wage tax. Effective July 1 2021 the rate for residents is 38398 percent and the rate for non-residents is 34481 percent. For non-residents the Wage and Earnings Tax rates will be 34481.

Philadelphia Wage Tax Non Resident. Non-residents who work in Philadelphia must also pay the Wage Tax. Wage Tax for Residents of Philadelphia.

Philadelphia imposes a Wage Tax on all salaries wages commissions and other compensation received by an individual for services. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate. Effective July 1 2019.

Applied to a median household income of roughly 90k in much of the suburbs the. 2Philadelphia wages earned Jan 1 2021 - Jun 30 2021 3Non-resident income-based Wage Tax due Multiply Line 2 x 0015 4Philadelphia wages earned Jul 1 2021 - Dec 31 2021 5Non. Philadelphia City Wage Tax Non Resident from.

Philadelphia City Wage Tax Non Resident from. 344 0344 The non-resident City Wage Tax applies to those. Furthermore the rate of earnings tax for.

Employers must begin withholding Wage Tax at. The Wage and Earnings taxes apply to salaries wages commission and other compensation. All Philadelphia residents regardless of.

The new rates are as follows. Furthermore the rate of earnings tax for. Philadelphia Wage Tax Non Resident.

Tax rate for nonresidents who work in Philadelphia. Effective July 1 2018. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent as of July 1 2021.

379 0379 Wage Tax for Non-residents of Philadelphia. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work. In addition non-residents who work in Philadelphia are required to pay the Wage Tax.

On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that. Its just a 0008 decrease in wage tax for non-residents who work in Philly to 344. Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during.

The Philadelphia Department of Revenue is. For residents and 344 for non-residents.

Philly S City Wage Tax Just Turned 75 Here S Its Dubious Legacy Technical Ly

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

Success Wage Tax Refund R Philadelphia

Philadelphia City Council Approves Business And Wage Tax Cuts In 5 6b Budget Deal Philadelphia Business Journal

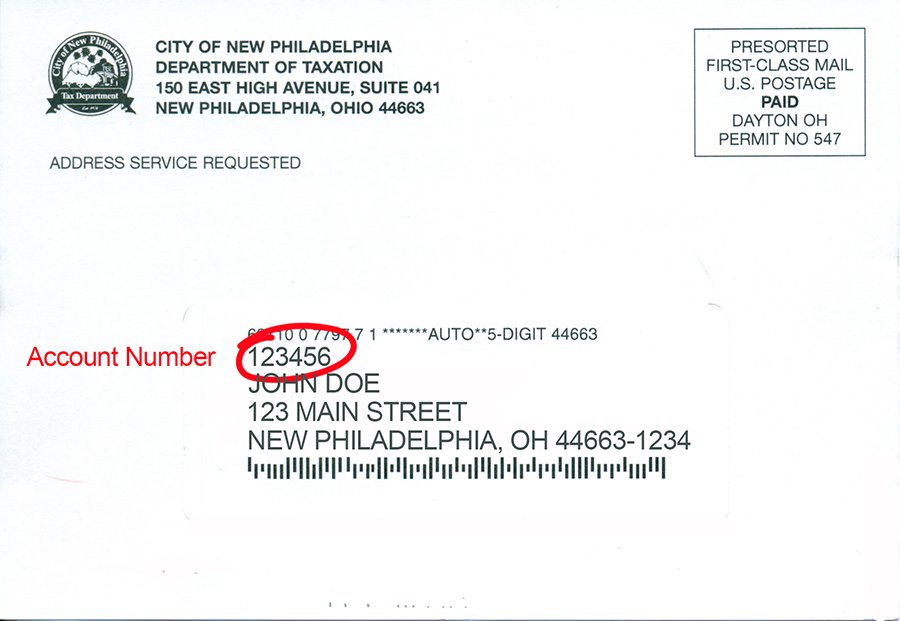

City Of New Philadelphia Income Tax Department

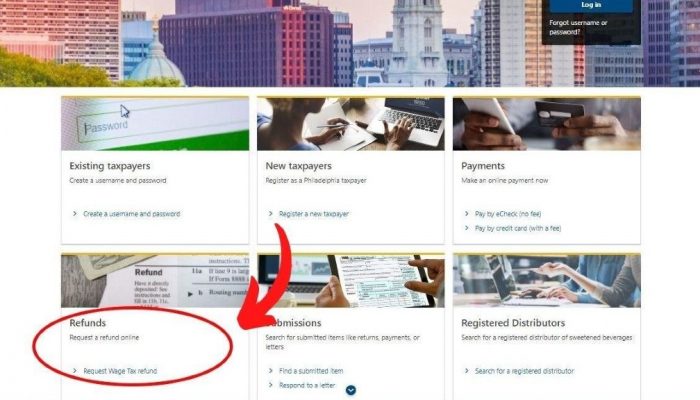

How To Get Your 2021 Philadelphia City Wage Tax Refund

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller

Bucks County Municipalities Want A Piece Of Their Residents Philadelphia Wage Tax

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Reduced Beginning July 1 Department Of Revenue City Of Philadelphia

Bucks County Residents Who Work For Companies Based In Philadelphia May Be Due A City Wage Tax Refund

Montgomery County Says Enough To Philadelphia Wage Tax

Philadelphia Wage Tax Refund Opportunities Tax Year 2020 Baker Tilly

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Businesses Now Allowed To File Philly Wage Tax Refunds For Non Resident Employees Legal Developers

Do I Have To File A Philadelphia City Tax Return

/cloudfront-us-east-1.images.arcpublishing.com/pmn/ZOGOD32VJFF2ZBX5J662HMUQ3A.jpg)

Philadelphia Wage Tax Cut Would Be Smaller For Commuters Than City Residents Under Budget Compromise